Addressing forced labour risks: what WROs reveal about supply chain blind spots

Addressing forced labour risks: what WROs reveal about supply chain blind spots

A recent Withhold Release Order (WRO) issued by the US Customs and Border Protection (CBP) on a bike parts manufacturer in Taiwan highlights the cost of overlooking blind spots in your supply chain. The financial damage from such detainments, or similar labour violations, can run into the millions (USD) for both brands and their manufacturing partners. And that’s before factoring in the reputational damage and operational disruption that comes with having products pulled from the US market.

The problem is that supply chain data has been signaling these types of labour risk hotspots for years. So why are they still being ignored?

A wake-up call for businesses

EiQ’s supply chain risk intelligence platform has flagged Taiwan as high risk for forced labour using data from tens of thousands of onsite audits each year. The CBP’s recent WRO against a Taiwan-based manufacturer cited multiple International Labour Organization (ILO) indicators of forced labour, including:

- Abuse of vulnerability

- Abusive working and living conditions

- Debt bondage

- Withholding of wages

- Excessive overtime

EiQ has flagged Taiwan as high-risk for forced labour violations for at least the past four years. Taiwan’s key risk drivers have included forced labour, inhumane treatment, wage issues and excessive working hours, which have all mostly hovered around the high-risk indicators, indicating exposure to these types of vulnerabilities are prevalent.

EiQ also analyses the social and environmental risks of specific products and commodities. Bike parts is rated as a ‘high-risk’ product, and among its key drivers are issues surrounding wages and working hours.

The bottom line? These risks are hiding in plain sight. And the result is that all bicycles, parts and accessories from this manufacturer in Taiwan are now detained at US ports. And this is not an isolated incident. WROs have been issued on companies in China, Malaysia, Mexico and more – and across a number of industries.

Source: CBP

A global pattern of risk

Taiwan is not an outlier. EiQ data shows that most key sourcing markets, including those in Southeast Asia, Latin America, and even markets such as the United States, Canada and Italy, are exhibiting high risk signals for forced labour.

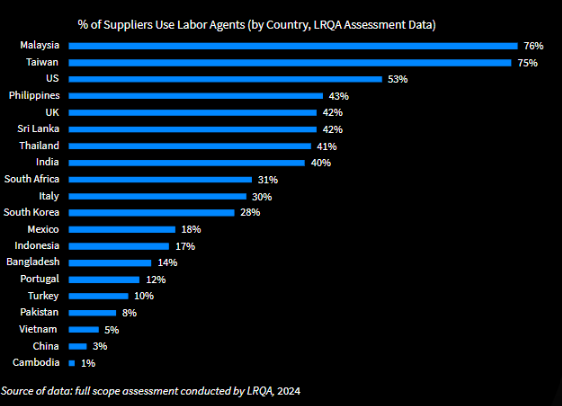

Compounding forced labour risks could be the rise of labour recruitment agencies operating across global supply chains, often in opaque conditions that increase worker vulnerability and obscure accountability. As migrant workers are often the most susceptible to exploitation, use of labour agencies can exacerbate risk for violations such as unlawful recruitment fees, document withholding and poor conditions for workers.

How to transform the pain points to performance drivers

So, what can you do to avoid becoming the next headline? Companies must shift from reactive to proactive, identify the gaps, adopt the right datasets and improve monitoring and targeted remediation efforts.

- Adopt the right data: Implementing supply chain risk ratings for countries, products and suppliers to continuously monitor supplier behavior and regional risk trends

- Implement adverse media scans to address blind spots: Monitoring adverse media to catch reputational risks before they escalate

- Prioritise worker voice: Leveraging grievance mechanism data to detect early warning signs from workers themselves

- Deliver targeted supplier training: Bespoke training courses can build awareness and compliance capacity at the source

These tools not only mitigate risk—they drive performance, transparency, and trust.

The costs of doing nothing

Forced labour enforcement is intensifying globally, and the regulatory landscape is evolving fast. While the EU experiences conflicting messages about the way forward with due diligence, other regions worldwide are intensifying their rhetoric around and signaling more stringent requirements. This most recent WRO is not an isolated incident, it’s a reminder that the outdated approaches will eventually catch up with you and the costs will set you back.

The financial implications of a WRO can be monumental. For manufacturers, costs can include:

- Detained goods and lost revenue

- Re-exportation or destruction of inventory

- Legal and compliance expenses

- Production delays and supplier reconfiguration

- Long-term reputational damage

Brands then face their own set of implications. This could result in:

- Lost sales and retailer fallout

- Crisis management and PR costs

- Investor scrutiny and consumer backlash

- The need to reengineer supply chains under pressure

In short, the cost of being reactive will outweigh the investment in proactive risk management. You have the tools. You have the data. You have the insights. The question now is: will you act on it?